Osmosis is the first decentralized exchange (DEX) on the Cosmos network that is build on Inter-Blockchain Communication (IBC) protocol.

The key differentiation between a centralised exchange VS a decentralised exchange is how the trades are transacted,

- Centralised exchange runs on an order-book (CLOB) model, where by in order for the trade to be executed, it requires a buyer and seller.

- On the other hand, Decentralised exchange runs on an Automated Market Maker (AMM) model, where the user will be trading against a liquidity pool.

Here's an article highlighting the difference between CLOB vs AMM model.

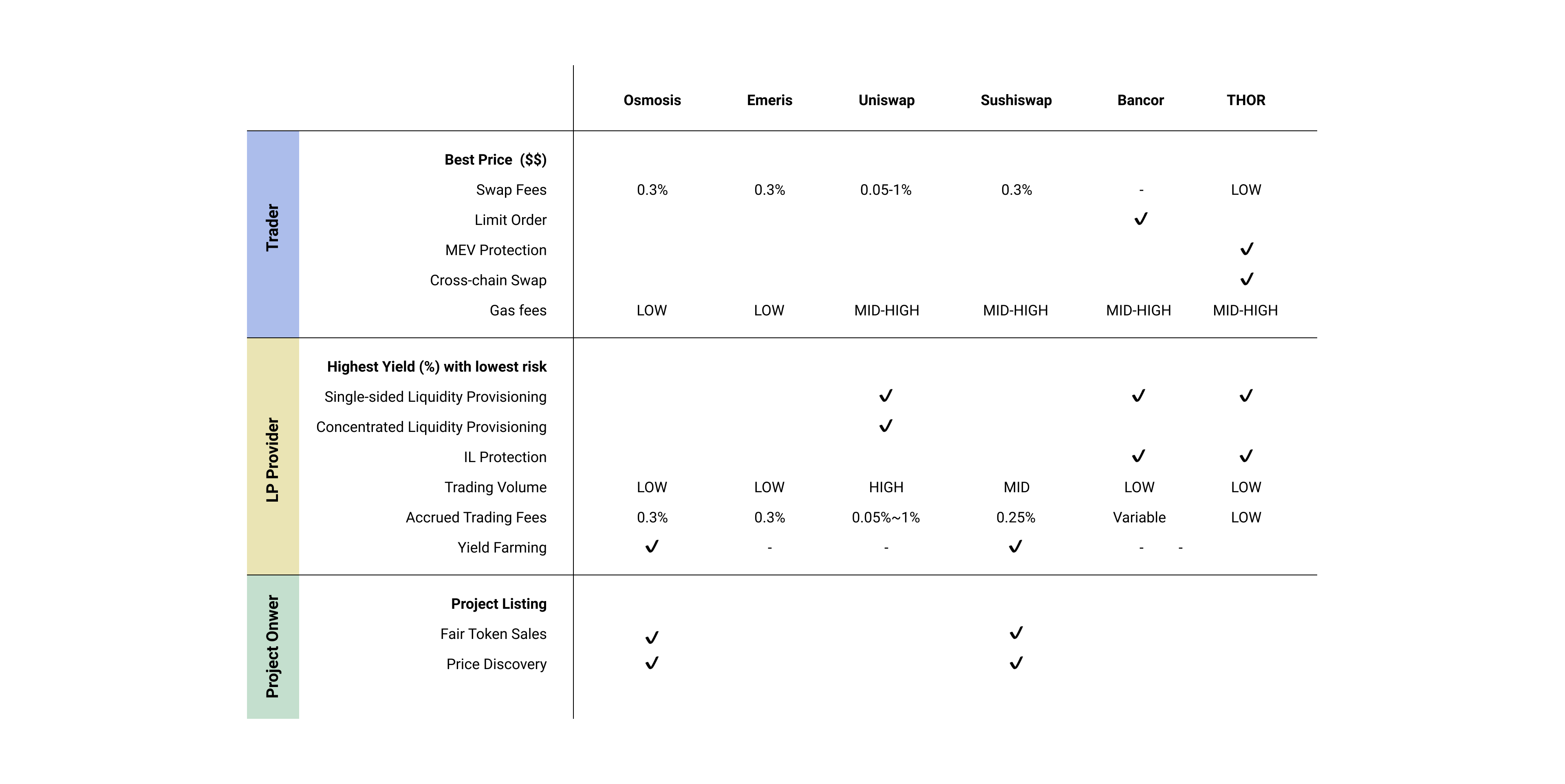

Upon identifying the customer needs, I have proceed to benchmark them against Osmosis competitors.

The Goal:

Opportunity Gaps Findings:

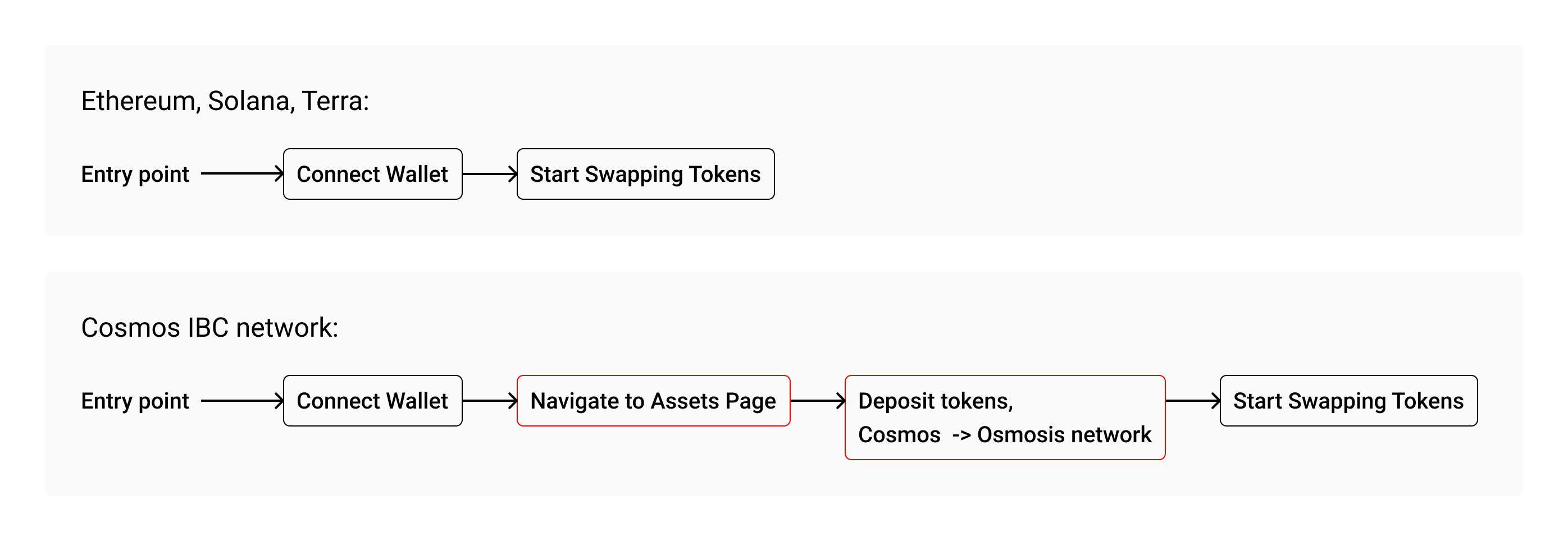

Majority of the crypto native users are coming from Ethereum, Solana and Terra network are used to the experience of connecting their wallets to the platform and start trading away.

However, on Osmosis or any other Decentralized Applications (Dapps) on IBC. Users are require to conduct 2 additional steps highlighed in red below:

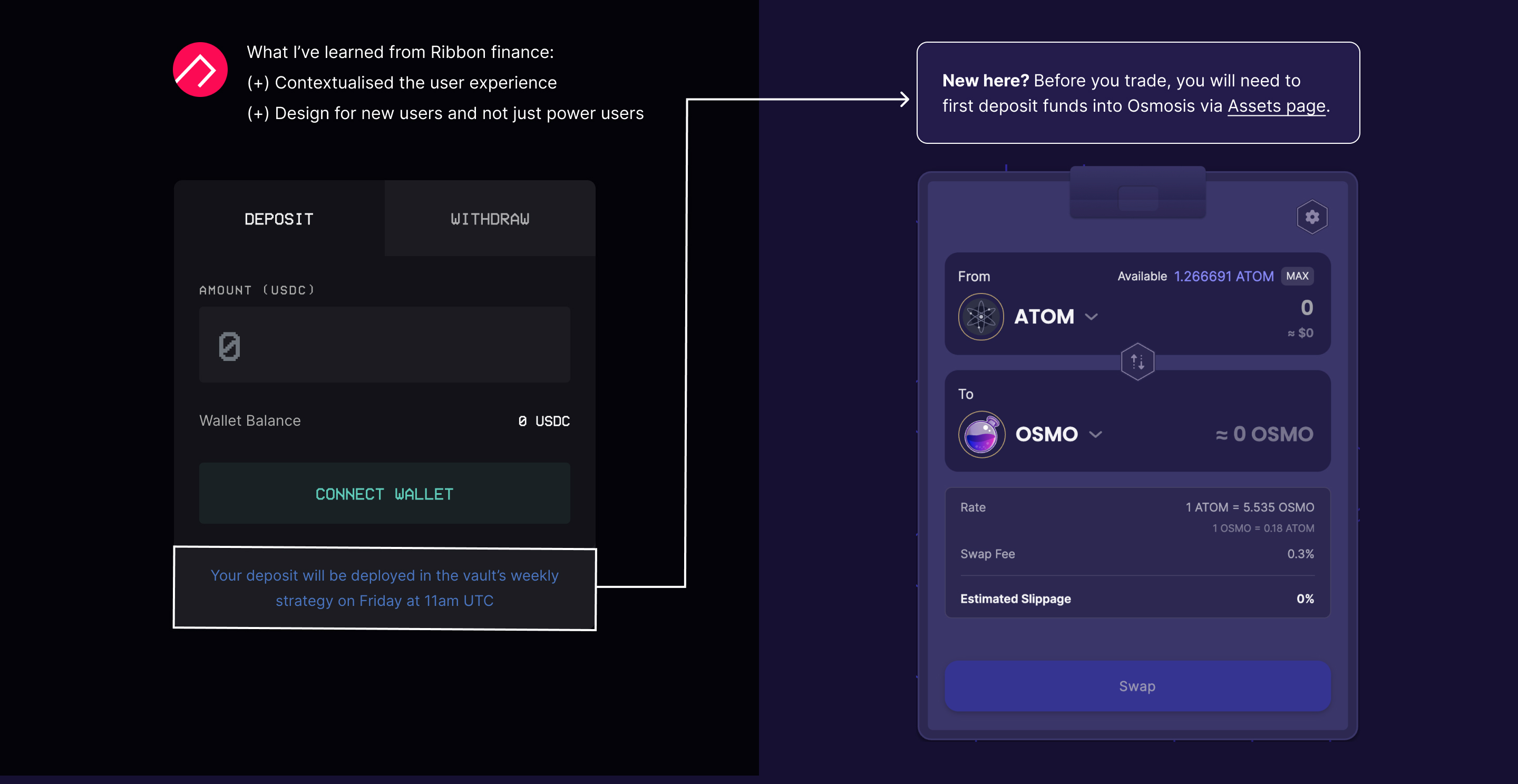

Providing the users with informative message. By simply adding a message on top of the swapping function, it creates awareness that they are required to first deposit, before they can start trading.

FYI - this is a quick fix. To access Mid-Long term strategic, please reach out for a walkthrough.

Key problems,

By using using a table out shown on the right, the users are able to

Before and After design shown below:

Currently, users are required to conduct this 2 steps in order to be receive liquidity mining rewards,

Most users tend to stop at step 1 as they may think that by 'Adding Liquidity', they have already started earning rewards. However, there is an additional step for the user to bond their LP position to rewards.

By adding a stepper, this helps the users to visually understand that there is a two step process that is required to start earning rewards. See image on the right >>

Current,

Potential next steps,

To find out more on how I have validate & invalidate some of the opportunities here, please feel free to reach out for a walkthrough.